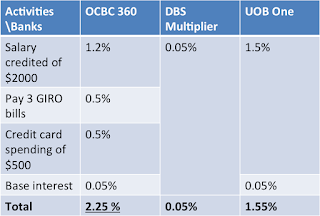

OCBC 360 vs DBS Multiplier vs UOB one

The top 3 banks in Singapore are offering attractive saving accounts for you to park their money at their bank.

DBS - DBS Multiplier programme

OCBC - OCBC 360 account

If you are a conservative spender like me who doesn't earn a lot, let see which account offers the best deal

Case 1:

Assuming salary credited of $2000

Credit card spending = $500

OCBC 360 wins in this case, paying the most interest of 2.25%.

Case 2:

OCBC 360 wins in this case, paying the most interest of 1.25%.

UOB wins in this case, paying the most interest of 1.05%.

DBS - DBS Multiplier programme

OCBC - OCBC 360 account

UOB - UOB One account

If you are a conservative spender like me who doesn't earn a lot, let see which account offers the best deal

Case 1:

Assuming salary credited of $2000

Credit card spending = $500

OCBC 360 wins in this case, paying the most interest of 2.25%.

Case 2:

Assuming salary credited of $2000

Refused to own credit cards, credit card spending = $0

Case 3:

Salary less than $2000/salary not GIRO into bank

Credit card spending = $500

UOB wins in this case, paying the most interest of 1.05%.

Depending on your income and monthly expenditures, different bank accounts will suit different people. DBS multiplier will suit the heavy investor, with interest of 2.08% if the Salary+ credit card spending + Home loan instalments + investment dividends amounts to $20,000 and above.

UOB will suit one who has salary <$2000/ Salary not paid by GIRO, but has credit card spending of >$500.

For OCBC 360, it will pay 1.2% if salary > $2000 is credited even if we do not do anything.

For me, it is bye DBS, hello OCBC :)

Comments

Post a Comment